Scan the QR code to download Dobin!

In Singapore, there is no such thing as owning a car if you’re on a tight budget.

It is a widely known fact that Singapore ranks as the most expensive country in the world to buy a car. Simply purchasing the mandatory 10-year Certificate of Entitlement (COE) can set you back a pricey $104,000 – and this is before even considering the price of the car itself.

Then there’s the issue of depreciation, meaning that the car’s value will reduce over time, further adding to the overall expense. Thankfully, we have the convenience of ride-hailing apps to get you to your destination without the financial burden of car ownership.

Whether you’re a die-hard fan of one particular app, or alternate between Grab, Gojek, Tada, Ryde, and CDG Zig, here at Dobin we believe that there are always opportunities to save more on your rides.

It is essential to set aside a budget for your ride-hailing expenses for the month. This amount can vary from person to person. It should take into account key factors such as your monthly salary, lifestyle habits, financial responsibilities, and how frequently you need to use ride-hailing services.

Example: If you’re a busy parent who needs to send your child to daycare before heading to the office, this might require ride-hailing services daily. If that’s the case, budgeting this expense becomes even more important.

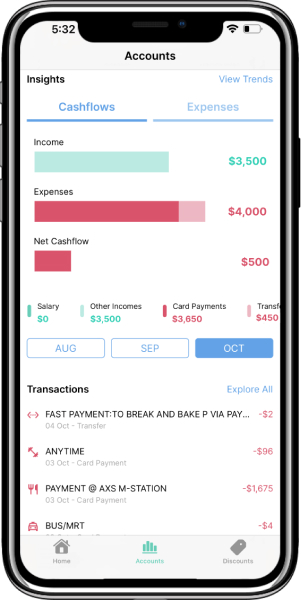

We recommend that you look into your monthly cash flow: how much money flows in (income) and flows out (expenses) every month. With Dobin, this step can be achieved in seconds by simply navigating to the Accounts tab (see below).

From here, allocate a comfortable range that you can set for ride-hailing without compromising your Essential Expenses (e.g. Mortgage, utility bills, groceries) as well as making sure there’s enough left over for your emergency fund, investment, and loan repayments.

For more information on budgeting, explore our guide on the 50-30-20 rule, a popular technique, and discover how the Dobin app can play a crucial role in optimising your finances.

What’s left should be what you’re able to splurge on ride-hailing. Remember, it’s important that the amount you’re budgeting for should strike a balance between convenience and being financially responsible. The last thing you want is to overspend on rides, putting a strain on your other expense categories.

Once you’ve set your budget, the next step is to ensure that you can stay within the limit without missing out on the convenience of ride-hailing.

Let’s explore the tips you need to help you save more.

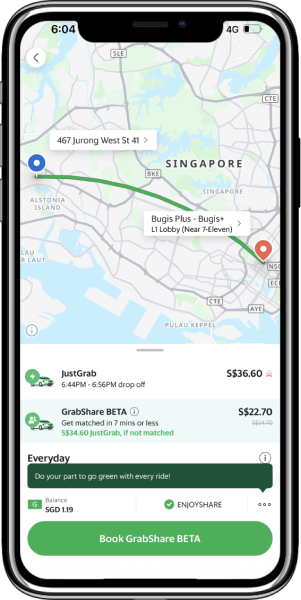

Sometimes, the more the merrier – when it comes to lower ride prices that is. Ordering a ride with GrabShare means that you’re sharing the ride with another person heading in the same direction as you. As you and your ride partner are both chipping into the cost of the ride, the cost becomes significantly reduced.

We tried booking a ride around peak hour (right after 6 p.m. on a Friday). The GrabShare BETA price is at $22.70 while the normal JustGrab option is at a whopping $36.60.

Based on these prices, GrabShare is 37.98% lower than JustGrab. However, some cons of this ride option include a longer time on the road (if you happen to be the second drop-off) and that there is only room for a single passenger (yourself). So it’s best to keep that in mind and give yourself more buffer time when planning your commute.

Many ride-hailing apps have a point system that allows you to earn points through every transaction you make with them. The more rides you take, the more points you earn, which results in a bigger amount you’re allowed to offset from the cost.

Some apps, however, come with a varied way of earning that’s more than just rides. This can come in the form of an in-app payment method (e.g. RydePay), online transactions done through GrabPay, and ride payments made with specific bank products (e.g. Gojek is running a promotion that deducts $13 off using DBS PayLah!).

If you’re already spending on rides on a weekly or monthly basis, might as well maximise it with rebates while you’re at it. Using the right credit card that offers cashback or miles when you spend on ride-hailing apps can make a difference in the value you get per trip – at the very least, you’re getting something back.

Start by looking up credit cards that are designed for ride-hailing spending.

At the time of writing, here’s a detailed look at how these credit cards reward you for each ride:

| Name of Card | Credit Card Type | Reward Details |

|---|---|---|

| UOB One Card | Cashback |

|

| Citi Rewards Card | Miles |

|

| OCBC 365 Credit Card | Cashback |

|

*Disclaimer: These credit card rewards are subject to change.

UOB One (rebates on all Grab services, such as GrabFood), Citi Rewards Card (earn points per dollar spent on rides), and OCBC 365 Credit Card (get cashback on ride-hailing apps and taxis).

Apps like Dobin can help you quickly find private hire-related offers and discounts, ensuring that you get the best deal. Simply navigate to the Discounts tab and type the name of your ride-hailing app in the search bar to get the results you need.

Sometimes, the tried and true method of comparing prices can really be the most effective solution to securing the lowest cost. Different apps can give you varying rates and promotions for the same route – you simply have to check.

Here at Dobin, our team did a quick experiment to see how much it would cost to get to Bugis Plus from Jurong. Bear in mind that this was done during a particular peak period (after 6 p.m. on a Friday).

The prices across the different ride-hailing apps showed vastly different prices.

| Grab: $37.80 |

|

| Gojek: $28.60 |

|

| Zig: $31.80 |

|

| Ryde: $28.10 |

|

| Tada: $22.69 |

|

Verdict:

This is where group chats come in handy. If you’re heading to a restaurant with your friend who happens to live close by, make a plan to share the cost of the ride by taking it together. Not only is it more budget-friendly, but it also gives you more quality time with your friends before the actual event. A win-win! What this entails is some coordination on your end to arrange a single pick-up point. Other than that, enjoy the ride, and don’t forget to split the bill.

Subscription plans are all the rage these days. Joining the hype of streaming platforms, ride-hailing has also announced subscription plans that promise to offer more savings for a fixed monthly fee. One example is GrabUnlimited, which offers a wide variety of deals across participating merchants on GrabFood, Grab rides as well as Grab Express.

At the time of writing, Grab Unlimited offers its first monthly subscription free, after which the fee will cost $5.99 a month. If you are a heavy Grab user, this is a plan that you could potentially reap significant savings from.

Suppose you’re spending a total of $325 per month on Grab rides and GrabFood. With GrabUnlimited, you can accumulate savings that add up to around $50, effectively reducing up to 15% of your overall expenses.

In conclusion, ride-hailing services are a great and convenient way to get around – but only if you’re managing your money wisely. By following these money-saving strategies, you can easily stay within your budget while getting to your destination comfortably.

Plus, with the slew of credit card promotions and ride options available, you will be able to book a service that works for you, without putting a strain on your finances.

Ready to dive into your finances? Download the Dobin app today.