Scan the QR code to download Dobin!

Feeling overwhelmed trying to juggle your expenses, bank accounts, and credit cards? You’re not alone. In today’s fast-paced world, managing finances can feel like a never-ending task.

Whether it's keeping track of your expenses, finding the right credit card, or understanding your overall financial health, these tasks often require multiple tools, endless research, and a lot of time.

This is where Dobin steps in — your all-in-one financial management app designed to simplify your financial life. Whether you’re looking to track expenses, explore credit cards, or evaluate your financial health, Dobin offers a seamless user experience.

Let’s explore how Dobin can help you streamline your financial journey.

Tracking expenses is key to managing your money , but it’s easier said than done. How many times have you looked at your bank account and wondered, ‘Where did it all go?’

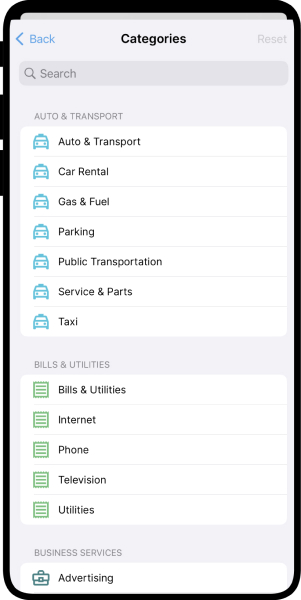

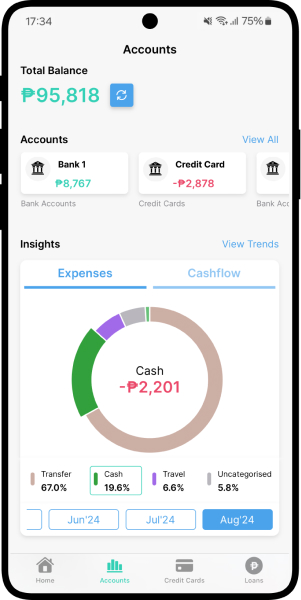

Dobin’s Expense Tracking feature changes the game by allowing you to connect your accounts and credit cards, and automatically categorising your transactions. Every peso you spend is automatically categorised into labels like groceries, food & dining, utilities, entertainment and so many more. This allows you to see a comprehensive view of your expenses at a glance.

Here’s how it works:

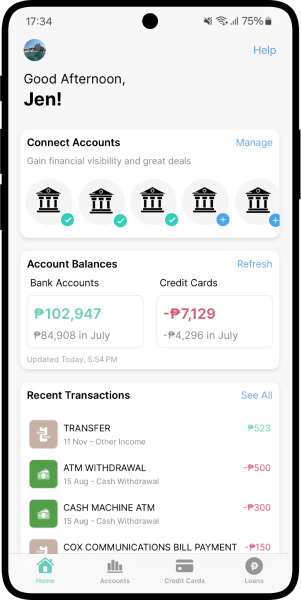

All-in-One Dashboard: Dobin aggregates all your financial transactions into a single, easy-to-understand dashboard, so you no longer need to juggle multiple apps.

Customisable Categories: You can create custom spending categories, making it easier to track specific types of spending relevant to your lifestyle or business. You can also change the category to your preferred choice of category.

Account-Level View: You can view your income, expenses, net cashflow and balances holistically and across each individual account.

With Dobin, you no longer need multiple apps to track spending — everything is at your fingertips in one easy-to-use app.

Credit cards are a powerful tool for earning rewards, saving on everyday purchases, and enjoying exclusive perks.

But how do you know which card gives you the best value? And what about your payment dates — or catching fraudulent charges?

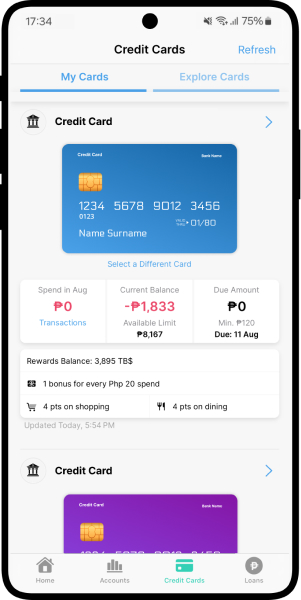

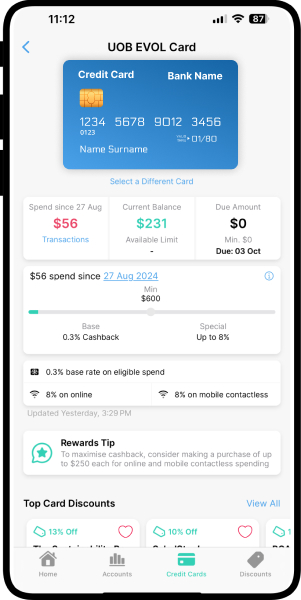

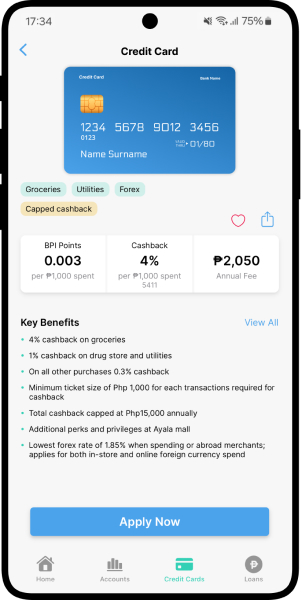

With Dobin’s Card Benefits Tracker, you can also get a consolidated view of your credit card spending in one place, so you can easily see how each card is performing. Whether you're earning cashback, collecting miles, or enjoying discounts, Dobin provides a summary of your credit card activity, helping you stay on top of your finances effortlessly.

But that's not all. Dobin also helps you explore and apply for new credit cards that align with your lifestyle and spending habits.

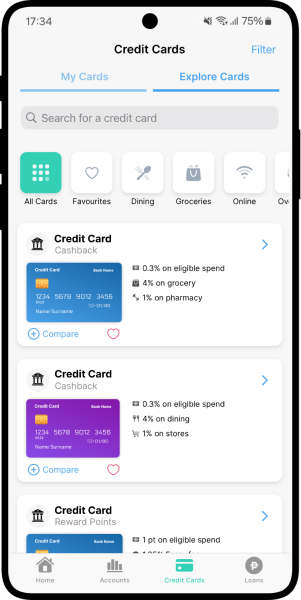

Dobin’s Explore Cards feature comes in. Instead of scrolling through countless bank websites and promotional emails, Dobin presents all this in a consolidated view.

Here’s what makes this feature so powerful:

Customisable filters: Dobin allows you to select from a range of filters including your annual income, the bank (card-issuer) and the card networks.

Key Benefits: Find all the key benefits of the card, the application process and the T&Cs.

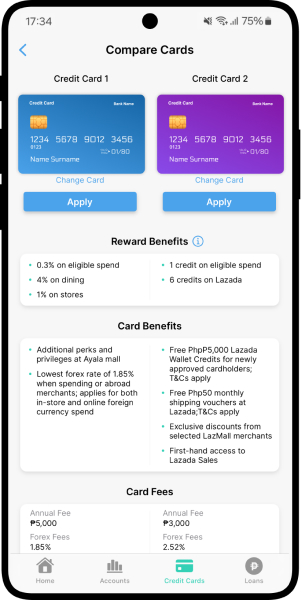

Compare Cards: Select any two cards and compare across the reward benefits, card benefits, card fees and application requirements.

Easy Application Process: Once you’ve found the right card, Dobin simplifies the application process by allowing you to apply directly through the app. No more time wasted switching between different platforms — Dobin streamlines the entire process.

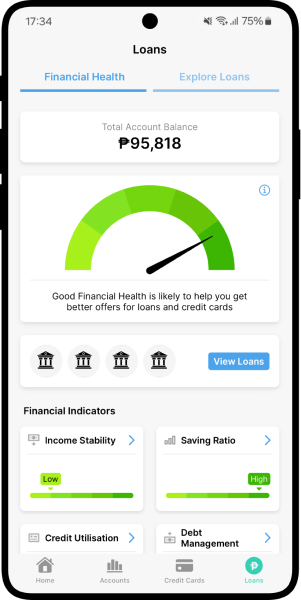

Your financial health can feel like a mystery — until it’s too late. That’s why staying on top of it is crucial, and Dobin’s Financial Health Indicator makes it easy to know where you stand.

Dobin is the first free app to introduce the Financial Health Indicator, a calculator designed specifically to gain a clear snapshot of your financial standing. This feature complements your credit score, giving you a comprehensive look at your financial health based on your bank accounts, credit card balances and pay-wallet data.

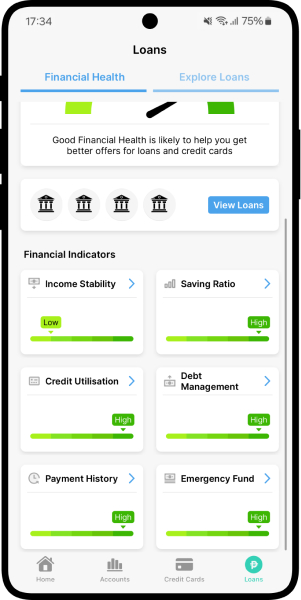

The Financial Health Indicator takes into account your income, spending habits, credit card usage, and debt levels to provide you with a detailed score that reflects your financial situation. Some of these key financial indicators include:

Income Stability: This measures the consistency and level of income from various sources, including salary, business and investments. This factor help determine the reliability of your cash inflows.

Savings Ratio: This metric assesses the percentage of income saved after covering essential and discretionary expenses. It indicates financial prudence and the ability to build reserves for future needs.

Credit Utilisation: This evaluates the ratio of credit used to available credit, focusing on credit card balances. It reflects responsible credit management and borrowing behaviour.

Debt Management: This metric analyses fixed credit obligations relative to income highlighting your capacity to manage and repay debts. A lower ratio suggests better debt management and loan eligibility.

Payment History: This tracks the regularity and timeliness of your credit repayments, including utilities and phone bills. Regular repayment behaviour demonstrates reliability and good credit risk management.

Emergency Fund: This metric measures the level of savings available to cover unexpected expenses by comparing total balance to average monthly expenses. This indicates financial resilience and preparedness for emergencies.

Dobin doesn’t just give you a score — it helps you understand how to improve it, so you can make smarter financial choices.

Need a loan for a major purchase? Whether you’re planning to finance a major purchase or consolidate debt, finding the right loan is essential — but it’s often a confusing and stressful process.

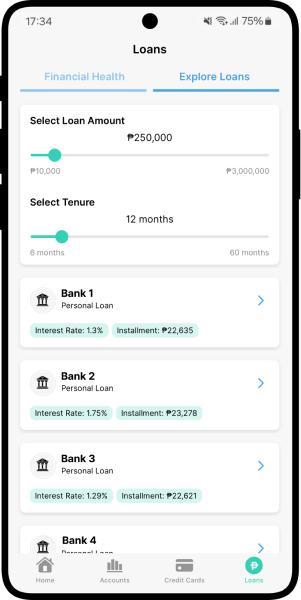

Dobin’s Explore Loans feature takes the hassle out of searching for multiple loans and applying for them. You can toggle between loan amounts and repayment options to find the one that fits your needs best. With Dobin, you’ll have everything you need to make the right decision — without the hassle of comparing loans manually.

Here’s how you can take full advantage of this feature:

Compare Multiple Loan Offers: Dobin allows you to view and compare loans from different banks based on factors like loan amount, repayment period and interest rates. With Dobin, you can explore the best options and get the loan that fits your needs.

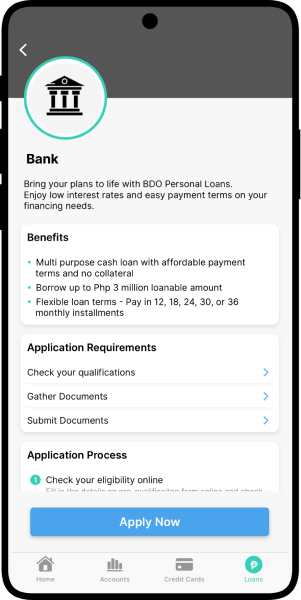

Simplified Loan Application Process: Once you’ve found the loan that suits your needs, you can apply directly through the app, saving time and ensuring a smooth application process. Dobin updates you on the necessary documentation required to ensure a smooth application process.

With Dobin, finding the right loan is easy. You can explore your options, compare offers, and apply — all in one place, with full confidence that you're making the best choice for your financial future.

Dobin isn’t just another finance app — it’s designed to meet your unique needs in your individual financial journey.

Take control of your finances today! Download the Dobin app from the App Store or Google Play, connect your bank accounts, and you’re all set!