Scan the QR code to download Dobin!

Are you guilty of neglecting your financial wellness in pursuit of your fitness goals? Alternatively, if you’re not a fitness buff, are you all about looking at your bank cashflow but not so much about nutrition or workout metrics?

No matter which camp you fall into, achieving optimal wellbeing across physical, and financial aspects is essential. Contrary to popular belief, wellbeing extends beyond just health, it encompasses our financial health too.

Fortunately, achieving financial wellness can be done by borrowing the habits of an athlete. All it takes is the right tools and data-driven strategies to get you in the best physical and financial shape –with the help of Dobin, Purpose, and SimplyActive.

Let’s get started.

Achieving optimal wellbeing is possible with an effective strategy, but with all good things, there are no shortcuts to making this happen.

In this article, we will break it down into 4 core steps, namely: Understand, define, track, and optimise.

![]()

One way to achieve both financial and physical health is by stepping into the shoes of an athlete. Manage your finances with an athlete's mindset, utilising tools akin to Garmin or Apple Watches for measuring performance and tracking progress. Similar to the discipline required in consistent training for athletes, financial wellbeing demands tracking expenses and making smart spending decisions, such as leveraging discounts and promotions.

Whether monitoring performance or managing expenses, the key lies in disciplined practices and utilising the right tools to achieve optimal results.

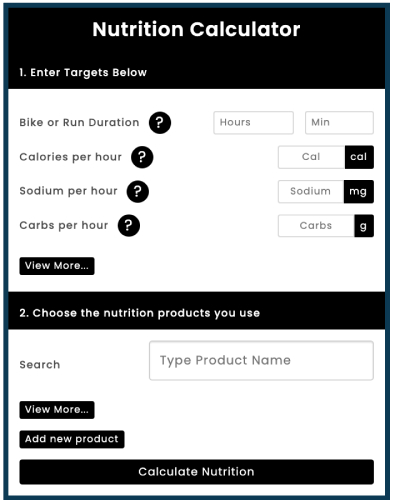

Nutrition is fuel, but the right products can be hard to figure out. Utilise Simply Active’s Nutrition Calculator to find the best combination of nutrition products that will supercharge your fitness.

The connection between physical and financial wellness is tightly intertwined. Much like achieving peak physical fitness, financial wellness is built through discipline, the cultivation of good habits, and the strategic use of data.

Below, we will explore the parallels of an avid runner’s fitness routine and how the similarities can be applied to improve your financial wellbeing.

Whether it’s setting your fitness or financial goals, establishing your baseline is important. It determines your starting point by assessing your current situation.

From a runner’s perspective, establishing your baseline would entail extracting insights from your fitness wearables to gauge your current fitness level. This could include checking your most recent running times, pace, and heart rate data from devices like Garmin.

Similarly, in the realm of personal finances, your current situation would come from understanding your disposable income. This involves calculating your net cashflow based on this formula:

Net cashflow = Income - Expenses

If the result is negative, it signals over-spending, prompting a need to optimise your expenses. However, a positive result indicates surplus cash, offering opportunities to save or invest based on your objectives.

Moving forward, it's essential to establish measurable goals and chart the course to achieve them. Once you've identified your guiding star, your journey towards holistic wellbeing begins.

In the realm of fitness, goal-setting is inherent, often revolving around surpassing personal bests. Utilise wearable fitness data to create tangible fitness milestones, such as aiming to decrease your heart rate over the same distance/pace within a specified timeframe.

Translating this goal-setting approach to finances, consider adopting the popular budget concept known as the 50-30-20 rule.

Start by assessing your income, summing up essential expenses (rent, utilities, food, transportation, etc.). Are you staying below 50% of your income? Next, total up non-essential expenses (restaurants, shopping, entertainment, etc.)—are you within 30% of your income?

Finally, examine your remaining income after you’ve subtracted total expenses. Do you have at least 20% of your income remaining that you can save, park in an emergency fund, or pay off a loan? These questions serve as a compass to steer you in the right financial direction.

Now, it's time for reflection – a quick assessment of the effectiveness of the steps outlined in #2 in bringing you closer to your goals. This involves comparing data across three months, providing a robust window for evaluating results.

To monitor your fitness progress, leverage your wearable device for its benchmarking features. Compare heart rate performance across a variety of activities such as long slow runs, sprints, and hill sessions to precisely track improvements over time.

To practice this for your finances, tracking progress involves delving into your monthly expenses. Assess whether they've decreased or increased over the designated months. Ideally, a positive outcome would be witnessing a consistent dip in your overall spending month after month.

Seeing progress? Now let’s power up by accelerating towards your fitness and financial goals.

From a physical fitness standpoint, implementing the right insights could involve recognising patterns in your heart rate to identify areas for improvement. After all, sleep can play a role here too. It is worth noting the correlation between sleep patterns and heart rate performance as it may prompt you to increase or decrease your amount of speedwork.

On the financial front, if you're seeing consistent progress in your savings potential and lower expenses over three consecutive months, it's time to channel that success into building wealth through strategic investing. Choosing the right investment vehicle can amplify your savings through the power of compounding, allowing your money to work harder for you—without breaking a sweat.

As we've explored the parallels between an athlete's routine and healthy financial habits, it is clear that success lies in discipline and utilising the right tools.

For athletes, on top of keeping consistent with their training regimen, what they wear and the supplements they take can make a real difference in their fitness. This is where high-quality supplements and comfortable training and racing apparel plays a pivotal role. Similarly, employing the right tools for seamless financial management, such as an all-in-one money management app, becomes crucial to tracking and achieving financial goals.

In the same vein, just as athletes optimise their training, individuals can optimise their finances, ensuring that their savings work harder for them. By embracing these principles, we pave the way for a truly holistic and optimal wellbeing, embodying both physical and financial wellness.

Through the collaboration of Dobin, Purpose, and SimplyActive, this unique approach empowers you to thrive in the core aspects of your life.

Ready to kickstart your fitness journey? Check out exclusive SimplyActive & Purpose vouchers on the Dobin app today!