Scan the QR code to download Dobin!

The word “cashback” gets thrown around a lot these days. Whether you’re more of an offline or online shopper (who isn’t guilty of buying stuff on Shopee?), we’ve all seen cashback promoted as a way to save money on everyday expenses.

Our recent Lazada 9.9 guide touches on cashback as a way to offset your total checkout balance depending on your voucher-stacking skills. Have a read!

But is it more than just a buzzword? If you’ve always been curious about how cashback actually works and want to learn more ways to maximise earnings, you’ve come to the right place.

In this article, we'll break down everything you need to know about cashback and take you through each step so you don’t miss out on more opportunities to save.

Let’s get started!

It may seem like a given. After all, the clue is in the name. Think of cashback as a way to earn back a portion of your spending. While the value varies, cashback often comes in the form of a discount or a reward.

Let’s break it down further.

| Who offers cashback | Examples | How to get cashback |

|---|---|---|

| Merchants/Marketplaces | Shopee, Lazada | At the point of sale or to offset a future purchase |

| Banks | Standard Chartered, OCBC | Will be reflected in your statement credit at the end of a billing cycle, offset by the bank |

| Platforms | ShopBack, Fave | Shop with their merchant partners or link your credit card to pay through the app |

Typically you would find cashback in one of these three places: merchants, banks (usually in the form of a credit card benefit), and shopping platforms.

Merchants/Marketplaces: If you’re spending in a marketplace, the most common way to earn cashback is once the purchase is complete. You can then use this cashback to offset a subsequent purchase.

Banks: You can also earn cashback via credit card spend. This allows you to get back a percentage of your credit card bill but with a catch–you would have to meet the minimum spend criteria within the allotted time frame. To be eligible, you might also need to spend within a specific category (eg. groceries, utilities, online shopping).

Platforms: Certain platforms provide cashback just by shopping with one of their merchant partners. They will give you back a cut of your total spend back in your e-wallet. After a brief verification period, you would eventually be allowed to withdraw the amount.

Earning cashback can be a huge advantage for your savings potential. It’s not free money, however. It gives you a chance to offset your total and allow your dollars to stretch further. It should not be an incentive to make you spend more than what you set out to do initially.

| Pros | Cons |

|---|---|

| ✅ Save money on purchases where you usually shop at | ❌ In some cases, you can only offset your cashback amount on future purchases |

| ✅ Easy to earn when you’re making a big spend (eg. groceries, pricey gadgets) | ❌ Comes with minimum spending requirements to earn the maximum cashback rate |

| ✅ Helps out your tribe (eg. referral programmes that reward cash based on successful signups) | ❌ Encourages you to spend more if you’re not careful |

| ✅ Offset essential spending (like monthly utility bills) when you spend with the right cashback credit card | ❌ Terms and conditions can be complicated, with many hoops to jump through |

How you swipe matters. It is always encouraged to have at least one cashback card in your arsenal for this reason–so you don’t miss on cashback rewards. Look for credit cards that offer attractive cashback rewards on categories that align with your spending habits, such as groceries, petrol, dining, or even ride-hailing.

| Card Name | Cashback Earn Rate | Minimum Spend Required | Eligible Spend Categories |

|---|---|---|---|

| UOB One Card | 10% | $2,000 | Includes groceries, petrol, Grab, dining |

| OCBC 365 Card | 6% | $800 | Includes dining, food delivery |

| CIMB Visa Signature Card | 10% | $600 | Includes groceries, online shopping, beauty and wellness |

| Standard Chartered Smart Credit Card | 6% | None | Bank’s selected merchants only |

*Disclaimer: This may change over time. Please check directly with your credit card provider for the latest information.

There are a number of websites and apps that offer cashback when you make a purchase with them. These platforms have partnerships with retailers, and they earn a commission on your purchase.

In turn, they share it with you in the form of cashback. Some apps that offer cashback rewards are Shopback and Fave.

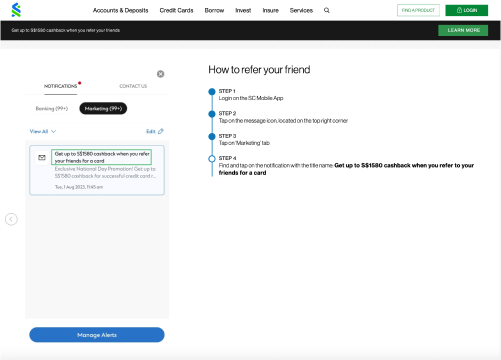

Source: Standard Chartered

Some retailers and apps offer referral bonuses, where you can earn cashback or rewards by referring friends or family members to sign up or use the service. If you’re not sure where to look, a good place to start would be mobile banking apps.

A quick scroll on the Standard Chartered app and you’ll stumble upon a referral programme that incentivizes you to get friends to sign up for a credit card. Seeing as it promises a relatively high cashback of up to $1,580, it’s not too shabby considering it’s a way to earn cashback without spending.

If you’ve been paying bills since you became an adult, you might as well be rewarded for it. Good news is there’s been a rise in cashback credit cards that offer rewards for paying monthly bills and utilities, such as electricity, water, and internet services.

Using your cashback card for these payments can help you earn rewards on the essentials, almost passively. The key is to find the right card.

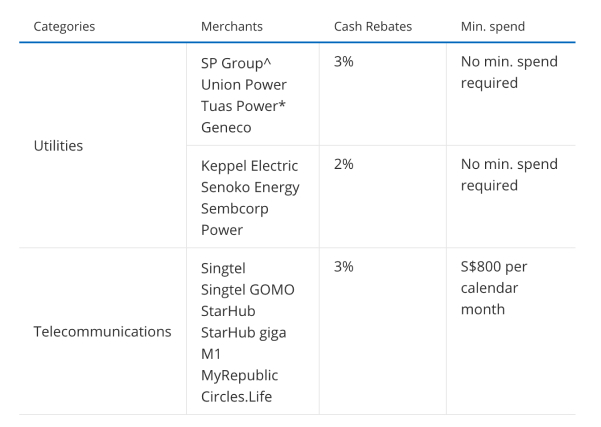

Source: POSB

Pictured above is the rewards overview if you spend using the POSB Everyday Card. Seeing how specific the eligible spend categories are, this card is a great example of earning cashback with a credit card that aligns with your spending habits.

If you’ve been paying your bills without cashback, this is a sign to leverage and even alleviate this expense with a relevant credit card.

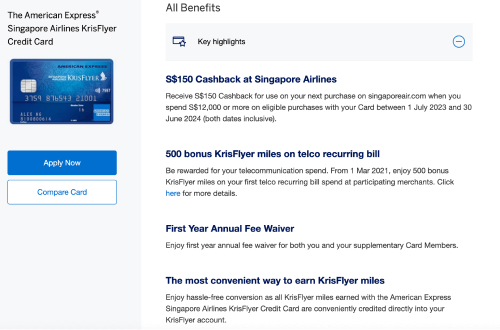

Source: American Express

Travel-friendly credit cards often offer cashback on travel-related expenses like flights, hotels, and even rental cars.

If you’re a frequent flyer with an affinity for Singapore Airlines flights, consider using a travel rewards card–like the American Express Singapore Airlines KrisFlyer Credit Card–to maximize cashback. They even offer bonus miles on top of the promised $150 cashback if you spend on a common recurring payment – telco bills!

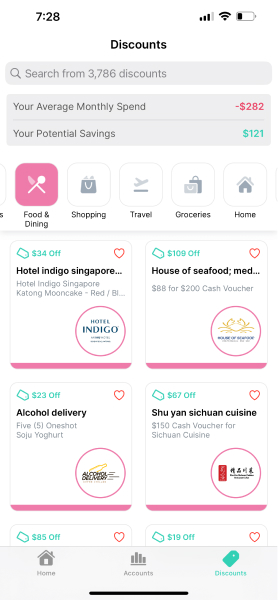

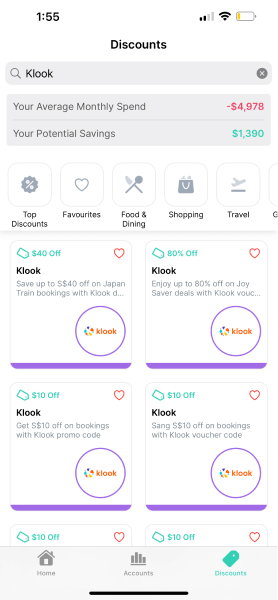

Keep an eye out for special promotions, discounts, or limited-time cashback offers from your favourite retailers and brands. While this can be a huge undertaking, you can easily streamline this process with Dobin.

Dobin scours the internet and curates thousands of online shopping deals to bring you high-value discounts. Simply tap on the Discounts tab to see all the promotions in one glance. Looking for a specific merchant? Type it out in the search bar and voila!

To maximize your cashback earnings, consider combining multiple strategies. For example, use a cashback credit card (preferably one that rewards you in the online shopping category) when you make payment in your Lazada haul, and be sure to stack cashback vouchers to earn even more cashback on a single purchase.

Cashback, for all intents and purposes, comes with strings attached. While you can definitely offset a good chunk of your spending and amp up your savings potential over time, the cashback promotion often comes with a minimum spending amount to qualify. And that could be hefty.

For example, the ever-popular UOB One Card offers a maximum of 15% cashback, one of the highest rates for a cashback credit card. However, you would need to spend a minimum of $2,000 per month to enjoy the maximum rate. If you’re not a big spender, the cashback rate drops to 3.33% instead.

If you’re not intending to spend that much, cashback could motivate you to overspend if you’re not careful. Earn cashback rewards if they align with your spending habits, not increase them unnecessarily. Bear this in mind before the next major shopping festival or grocery run. Always stay disciplined when it comes to your spending–you got this!

Ready to offset your spending with the brands you love instantly? Download Dobin today!