Scan the QR code to download Dobin!

For credit card connoisseurs, nothing gets more exciting than discovering new hacks to earn more rewards. The thrill of optimising your spending and maximising rewards is the cherry on top – and with good reason.

Cracking the code to smart credit card spending can open doors to a whole world of exclusive rewards and endless promotions, including sought-after sign-up gifts such as Dyson gadgets and Apple products. Once you’ve mastered the credit card game, it can lead to limitless possibilities for savvy users.

If you’ve been wondering how to elevate your credit card strategy to reap higher rewards, you’re in the right place. Earning rewards can be effortless if you’re using the right tools to steer you in the right direction. Dobin is the financial companion you need to set you up for success.

Ready to boost your rewards game? Let’s dive into the key steps below.

There is no such thing as too many offers in the credit card world – but there are limited windows for when these exclusive discounts are valid. Managing multiple cards means they can be easily missed if you’re not using the right app to track them all. Leverage an app that keeps track of your credit cards and their associated rewards, all in one place.

Credit card offers have never been this effortless. Use Dobin to pinpoint the exact discounts you’re eligible for, seamlessly offsetting spend with your linked credit cards.

This just goes to show that it takes an awareness of your spending habits to rack up major points. If you find that car-related payments or groceries take up a significant amount of your expenses, it’s best to find cards that reward cashback for those exact spend categories. That way, you can earn effortlessly without jumping through hoops to meet the minimum spend requirements.

This might be a no-brainer but for those who have not yet made it a habit, we highly recommend paying off your entire credit card bill every month, on a timely basis. This ensures that you don’t lose your benefits and maintain a healthy credit score.

Luckily, the Dobin app comes with a helpful feature that not only lets you know when the bill is due, but you can also set a reminder on the app so it can alert you when it's approaching that date.

Credit cards come with fine print, especially for their welcome bonuses and the minimum spend you need to make per month. Be sure to take your time to research what it takes to qualify before you commit to the card. The fine print will also tell you what you must do to ensure you qualify for the card’s bonuses and/or promotions, such as paying the annual credit card fee.

Before you make the call to waive that annual fee, do a quick double-check of the card’s terms and conditions. Don’t risk seeing your hard-earned points fade into the void unnecessarily.

In the credit card game, patience is a virtue. While it’s true that you can speed up the accumulation of your rewards just by fulfilling the steps highlighted above, consistently accumulating points over time is key to maximising overall benefits. It’s important to remember that earning points should never justify overspending by any means–it should complement your current financial situation, not worsen it.

Using an expense tracker app like Dobin can be the companion you need while expertly navigating the credit card world. Dobin gives you a comprehensive overview of key metrics such as your monthly spend, the due date of your credit card bill, and your current balance – across 8 different credit card issuers.

Ready to earn some serious points? We’ve scoured the highly competitive credit card landscape to find the best ones that give you generous rewards with each spend.

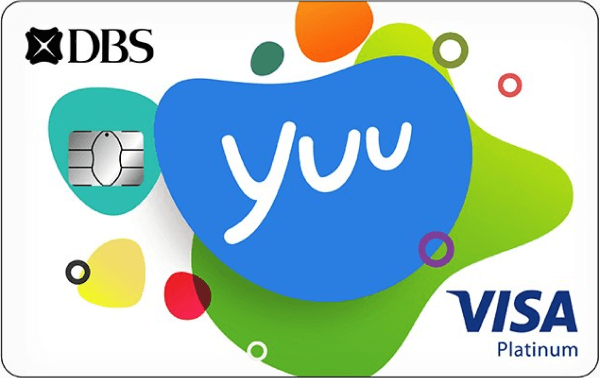

| 1 yuu point for every $1 eligible spend | 10 yuu points on participating merchant spend | 1 yuu point = 0.5% cash rebate |

You’ve probably heard of the yuu card repeatedly whenever you visit a supermarket, but the earnings you get are worth adding this card to your arsenal. With a rate of up to 18%, the yuu card has surpassed even the cult-favourite UOB One card in potential earnings.

If you find that your grocery expenses are one of your biggest expense categories, we would recommend that you sign up for this card for effortless cashback.

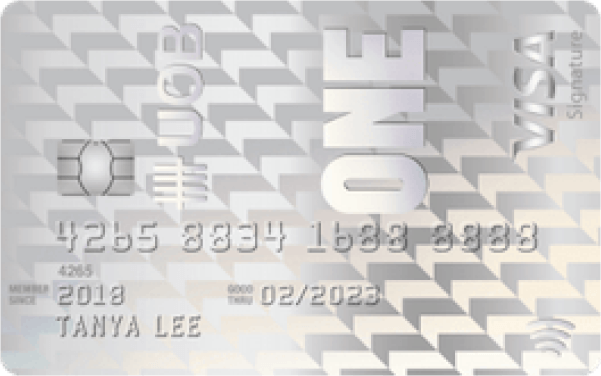

| 0.03% base rate on eligible spend | $200 cashback if min. $2,000 spend reached | $100 cashback if min. $1,000 spend reached |

A staple for cashback earners, the UOB One Card still reigns supreme in the cashback category for those seeking to offset their monthly credit card bill with substantial savings. Offering a tiered cashback structure ranging from online shopping to utilities, it is one of the best ways to earn cashback for general spending – so you can shop without the stress of checking if it’s a qualified spend.

| UNI$1 for every $5 eligible spend | UNI$10 for every $5 on selected online spend | UNI$10 for every $5 on mobile contactless spend |

There’s a good reason why this card is consistently high on any passionate mile-chaser’s list. From flight bookings to everyday spending, every transaction accumulates miles – bringing you closer to that “free” business class trip. Whether you’re spending locally or overseas, this card should be on your radar simply because of its generous miles per dollar (mpd).

| 1 point for every $1 eligible spend | 10 points for every $1 on selected online and contactless spend | Additional 1% cashback with HSBC Everyday+ |

With no minimum spend required and no annual fee, this card is great for anyone wishing to earn miles for each contactless payment and online shopping spree. So, next time you’re checking out your cart on Shopee, Lazada, or Taobao – be sure to charge it to this card for fuss-free miles.

| 10x points for online purchases | 10x points for in-store shopping purchases | 1x point for other purchase types |

If you want to ensure you’re making full use of your online shopping to maximise your miles, then this card is your best bet. Unlock mpd for a wide range of online payments, including food delivery, ride-hailing apps, and more. There’s even a sign-up bonus to give you a decent head start – but be sure to read the T&Cs to ensure you qualify for it at the end of the day.

Raking in rewards is all fun and games, but if you’re not managing your credit cards well, it might lead to mismanagement if you’re not careful. This means missing your due dates, losing track of how much you’re spending across the different cards, and possibly overlooking fraudulent charges.

Dobin’s My Credit Cards feature is designed to ensure you’re on top of all your credit cards, whether you have 3 or 30 cards. Simply connect your credit cards to keep them in an all-in-one view, together with important information such as your spending for the month, current balance, and most importantly, your statement’s due amount.

Simply update your Dobin app here to enhance your credit card management.