Scan the QR code to download Dobin!

The finance management app you’ve been waiting for is officially here! 🎉

Dobin is ready to help you revolutionise your finances and reach your money goals faster than ever. With an easy-to-understand, unified dashboard providing financial insights and curated discounts, Dobin is the ultimate app for better money management.

So, let’s take a deep dive into how Dobin works and how exactly one free app can improve your financial well-being.

We all know that we need to better manage our money. Whether you’re a savings whizz, the ultimate shopaholic, or a paycheck-to-paycheck kind of person, we all know it’s challenging to stay on top of your spending.

In fact, managing money is becoming more complicated. Now, we are all more likely to have multiple credit cards , an e-wallet balance , and a savings account (or two). All of that is hard to keep track of.

This is where Dobin comes in — the one app that helps you manage your personal finances.

Dobin utilises the concept of open finance, already popular in Europe, Australia, and the USA, to consolidate your financial information in one place. When you open the Dobin App for the first time, you can choose to connect Dobin with your bank accounts and credit cards for ultimate visibility.

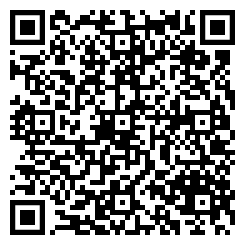

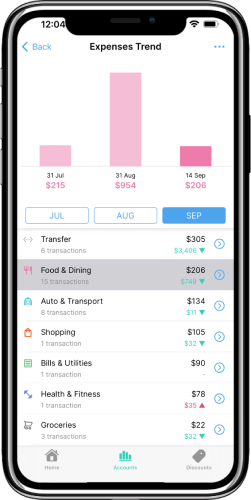

Image 1: When you open Dobin, you can choose what banks to connect to the dashboard. Dobin works with your bank and financial service provider, and you are always completely in control of what Dobin sees and how your data is used.

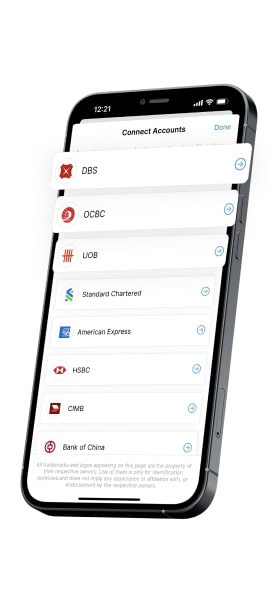

Then, Dobin will automatically aggregate your balance and transaction data from your different accounts into an easy-to-read dashboard. This helps you manage all your money in one place, helping you track trends in your spending and income, plan for the future, and get the most out of your reward programs.

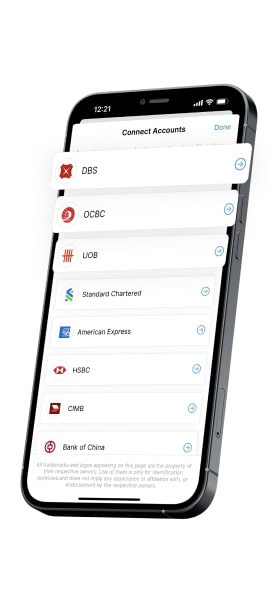

Image 2: Dobin lets you see all your financial information in an intuitive snapshot – identifying trends, giving you informed insights, and helping you manage your money more effectively.

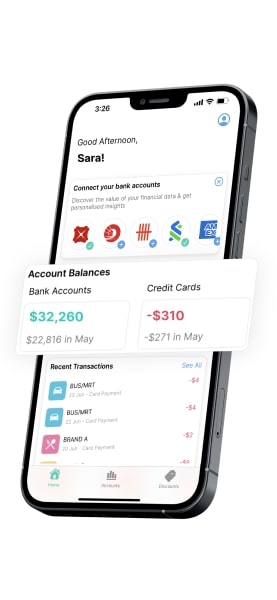

In just one app, you can dive into your data and see how much money you spend each month on various categories. You can see your net worth, hone in on any areas of overspending, and take steps to improve how you manage your money.

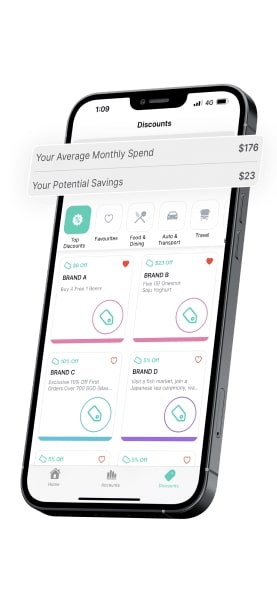

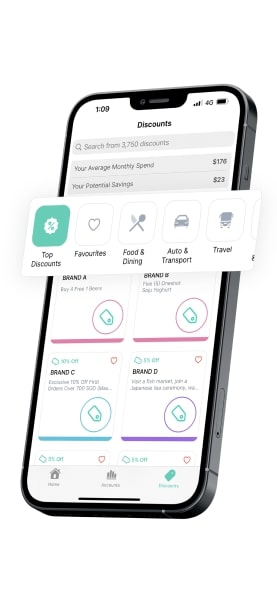

But that is not all! Once you have created your dashboard, you can put your data to good use. Dobin will analyse your information and make intelligent recommendations for financial products and rewards that will benefit you. This way, Dobin helps you find the best products for your needs, saving you money and matching you with financial services that suit you.

Having a complete view of your financial information at your fingertips is powerful. Without managing a complicated spreadsheet or hiring a financial advisor, you can see the whole picture of your finances and make informed decisions about your future.

By aggregating your financial information, it’s much easier to keep your spending in check, set goals and track your progress, and make the most of the rewards you are entitled to. In one handy dashboard, you can aggregate total expenditures and savings, then drill down into spending by category. Then, you can use that data to get rewarded, enjoying personalised offers tailored to your spending.

Plus, all this is automated — once you have linked your accounts, Dobin does the rest. Simply fire up Dobin and you can see an accurate picture of your finances at that moment, helping you decide how to use your money to get the most from it.

Let’s take a look at how Dobin does it.

When you download the Dobin app for the first time, you’ll be prompted to link Dobin to your accounts. It is up to you to decide which accounts you link, but for the best results and a complete picture, we always recommend linking all the accounts you use.

Once you have logged in and set up your accounts, Dobin pulls your account balances and transactions, creating your dashboard. The app then consolidates your accounts and analyses your data to create insights. This means you can keep track of your monthly spending, review your savings goals, and stay on top of your bills.

Then, by understanding your purchasing habits, Dobin curates discounts and cashback deals from various brands and categories in Singapore to help you offset your costs on your daily expenses. No more boring deals for products you never use; Dobin is tailored to you.

Getting the most from your financial data is great, but how does Dobin ensure that your personal data remains safe, secure and private?

Dobin takes your data security matters seriously. As such, you decide which bank accounts you wish to connect to Dobin and will ask for your explicit permission before doing so. For added security, Dobin applies multi-layer encryption to safeguard your financial data.

You’re always in control of your data. You have the full choice of what information you want to share with Dobin. At any time, you can access it, delete it, or revoke it. We never share it with anyone without you saying we can. This control is critical for Dobin — we always put you in charge.

Dobin finally has lift-off, and our big launch is here. Now, you can download the app today, connect your accounts, and get ready to revolutionise your personal finances.

Download Dobin today!