Scan the QR code to download Dobin!

Revenge travel in the works?

It’s no surprise that traveling overseas is high on your priority list, especially for Singaporeans. According to a survey conducted by Amadeus, about 46% of Singaporeans wish to spend on an international trip over other expense categories (eg. buying clothes, dining out, subscriptions, etc.).

Interestingly, the survey also found that Singaporeans are likely to spend an average of $3,468 on their international holiday, albeit over a span of 12 months.

If you’re planning your own getaway and are worried about overspending, then you’re in luck.

We’ve put together a budget-friendly guide that will help you manage your money at each stage of your trip–all with the help of your trusty financial companion, Dobin!

Let’s say you’ve decided on a sun-soaked getaway to Bali. This is a great start. Now we’ll have to take a look at your finances to see how much you can responsibly set aside for the trip.

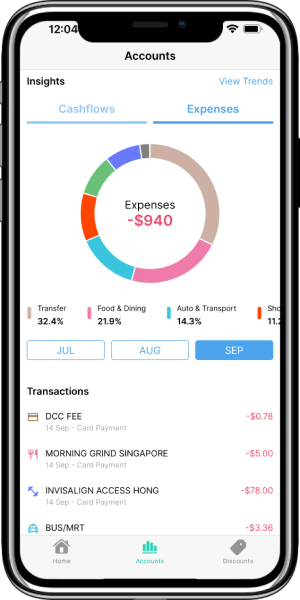

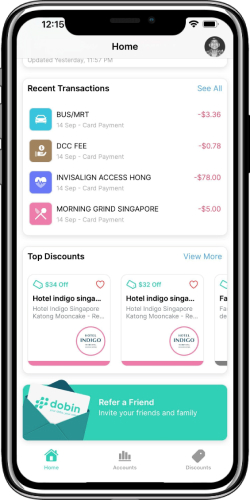

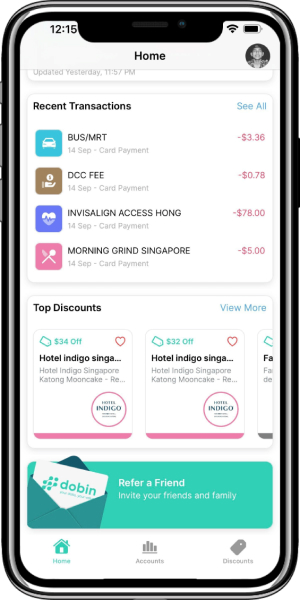

The Dobin app makes this easy by providing you with clear insights into your spending habits and expenses per month.

With this in mind, we can do the following:

Track your spending: The app instantly organises your expenses by category. This is key to help you identify areas where you can cut back (for the time being) to save for your big trip.

For example, you can see an overview of how much you’ve spent on categories such as Health & Fitness, Food & Dining, Shopping and Travel under Dobin’s Accounts tab.

Find out exactly how much by consolidating your total spending by categories

We suggest cutting back on nice-to-have but not necessarily need-to-have splurges such as Grab rides and food delivery. These expenses can easily take up a good chunk of your monthly spending while you can easily save for more fun in the sun in Bali.

Create a budget: Take into consideration your income and essential expenses. Now that you know how much you’ve spent each month, this allows you to estimate how much you can afford to save, plus any excess funds you may have left over. Based on this, carve out a portion of it to funnel into your Bali trip savings.

| Examples of essential expenses |

|---|

|

Monitor your progress: Leading up to the trip, make it a habit to regularly check the Dobin app to see how much you’re spending and whether you’re on track to meeting your savings goal for the month.

Time to make Bali official by booking your round-trip flight and accommodation!

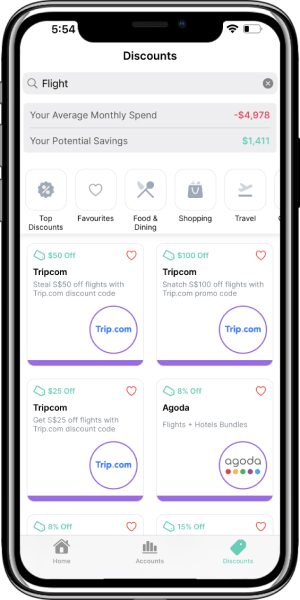

Luckily, keeping this expense within budget is not as stressful as it once was. The Dobin app connects you with the best deals without having to go down a spam-filled rabbit hole. Tap on the “Discounts” tab, type things you need like “flight” and “hotel” into the search bar and it’ll generate relevant vouchers you can redeem in seconds.

In this example, the first result offers a 50% discount on both flight and hotel on travel booking platform, Trip.com. The savings earned can go a long way to meeting your savings goal.

However, it’s good practice to read the disclaimer (if any) to find out whether you qualify for the offer.

Now that you’re exploring Dobin’s Discounts tab, don’t miss the chance to secure a few fun activities before the trip. This, of course, should be within your budget. Search for travel platforms such as “Klook'' and “Trip.com” and see the promotions that pop up.

Making bookings in advance also prevents pricey, last minute bookings during your vacation, leaving you more time to enjoy yourself.

This might be a big ask if you’re busy enjoying your vacation but be sure to pay close attention to your transactions during the trip itself.

Ideally, you should refresh your Dobin app at the end of each day to see if there are any charges that could derail your assigned travel budget. Make adjustments or cut back accordingly the following day.

We understand that travelling is costly and the expenses quickly add up, even if

you’re keeping

a close eye on your spending.

A sure-fire way to recuperate financially while you’re on vacation is to

designate a full day to

free sight-seeing. Google is your best friend for this.

The downside of travel is that it might expose you to unauthorised or even double charges on your credit card. Use the Dobin app to monitor your transactions regularly throughout your trip. Once you’ve spotted an unfamiliar charge, it’s best to flag it to your bank right away.

Once you’re back and fully rested, open up your Dobin app to tag all your expenses related to your trip to make it easier for you to see your total spend.

Here’s how:

Tap “See All” next to “Recent Transactions”

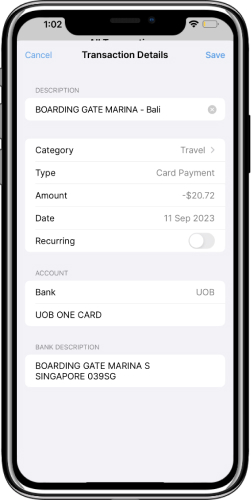

Scroll through your transactions and identify the ones made for the trip. Tap on the transaction you wish to tag.

Under “Description”, indicate the name of your trip behind the main expense title. For example, we tagged “Bali” so that it will look like this “BOARDING GATE MARINA - Bali”

Ensure that you’ve set the transaction’s category to “Travel”

Tap “Done”

Repeat these steps for the other transactions until you’ve covered them all

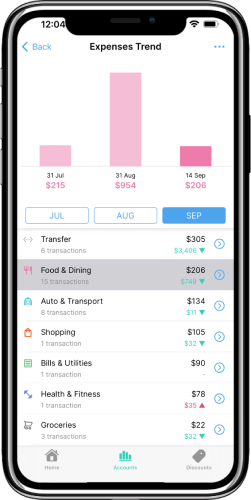

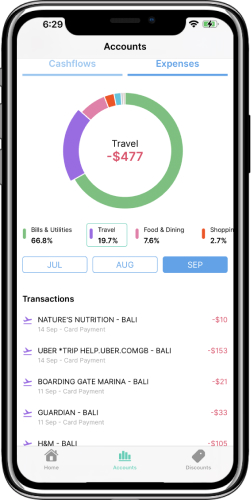

The moment of truth has arrived! With the power of Dobin’s “Expenses Trend” feature, you should be able to consolidate your travel spending in no time.

Head to the “Accounts” tab at the bottom of your homepage

Under “Insights” tap on “Expenses”

Swipe left under the “Expenses” chart until you find the “Travel” category

Tap on “Travel” to see how much you spent during your Bali trip

Based on the above, you can see how much you’ve spent under this particular expense tag. All that’s left to do is check your total trip expenses against your travel budget.

Whether you’ve successfully kept it within your budget or found that you’ve blown it slightly, the insights you’ve gathered from this trip should give you a better idea of how to make smarter decisions for your next holiday.

Dobin is here to help you, anytime anywhere.

It’s becoming increasingly apparent that proper budgeting comes from having a clear understanding of your financial situation. Only from seeing our spending habits and expenses trends can we determine the areas to save instead of spend.

With the right financial data at your fingertips, setting a plan to save before the trip can be manageable. You can make smart financial decisions that won’t lead to financial stress once you’re back from your vacation.

![]()

Dobin’s Discounts feature came in handy to offset extra travel costs to ensure each dollar spent goes a long way.

There’s no better way to achieve a budget-friendly trip when you have two strategies on your side: financial visibility and high-value merchant discounts for every spend.

Ready to get started? Download the Dobin app today.